Promoting education and transparency for healthcare consumers

HEALTH INSURANCE

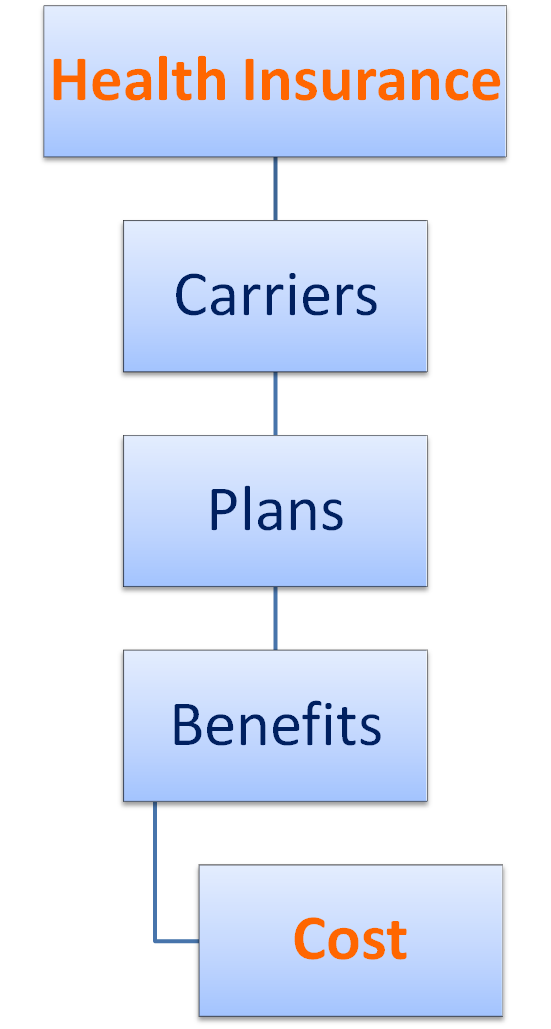

Health insurance is broadly defined as insurance against loss due to poor health. It covers a portion of medical costs according to the benefits of an individual's specific plan. The right health insurance plan can go a long way in minimizing healthcare costs for individuals and families. You might not be able to choose your plan if coverage is provided by an employer, but recent healthcare legislation is changing the way many Americans will obtain health insurance in the future. Regardless, understanding health insurance will aid you in utilizing your benefits more effectively. Our goal here will be to investigate health insurance carriers, plan types, and benefit components and use this information to discuss finding the best plan for you. We'll then touch on a few more helpful topics relating to health insurance, and finally, we'll offer some resources should you wish to explore the topic further.

Health Insurance Carriers

Health insurance carriers, or providers, are the companies or organizations that provide health insurance plans and administer health insurance benefits. Carriers include public health insurance providers like Medicare and Medicaid, as well as private health insurance providers like United Healthcare, Anthem Blue Cross & Blue shield, Aetna, and Cigna to name a few.

Learn moreTypes of Health Insurance Plans

You may have run across terms like fee-for-service (FFS), preferred provider organization (PPO), health maintenance organization (HMO), point of service (POS) and the like. These days, these terms most commonly refer to health insurance plan types, and benefits can vary depending on what type of plan one is on.

Learn moreHealth Plan Benefit Components

If you have ever reviewed your health insurance plan benefits, you've probably seen terms like copay, coinsurance, deductible, out-of-pocket maximum, in-network, out-of-network, inpatient, and outpatient among others. Interpreting all of this information can be difficult, but knowledge of these components is important as the benefits of your particular plan will affect your monthly premium as well as your out-of-pocket expenses.

Learn moreIn-Network vs Out-of-Network Care

In-network vs out-of-network care is a recurring theme, and we believe it is important enough to warrant it's own discussion here.

Learn moreChoosing the Right Plan for You

While Healthcare Whiz cannot help each individual select a health insurance plan suited for his or her particular needs, we can offer some general advice that will help in the selection of an appropriate plan. This information will aid those in search of coverage in the health insurance marketplace/exchange as well as those analyzing how their current plan fits their particular needs. The goal is to minimize the total cost of the plan by balancing premium payments with out-of-pocket costs for medical care.

Learn moreHealth Insurance Marketplace/Exchange

Part of the Affordable Care Act, also known as Obamacare, the Health Insurance Marketplace, or Exchange, allows individuals who do not receive health insurance through their employer and do not qualify for public health insurance to shop for coverage and find a plan that fits their needs. This new resource has been developed in part to aid individuals in procuring health insurance due to the individual mandate of coverage that is also part of the Affordable Care Act. States have the option of operating their own exchange, operating an exchange in partnership with the federal government, or allowing the federal government to run the exchange. To find out your state's status, click here.

Learn moreTiers of Coverage

Tiers of health insurance coverage refer to the situations that arise when individuals are covered by more than one health insurance plan; thus, one plan is the primary insurance, the next becomes the secondary insurance, a third would be tertiary coverage, and so on. Tiers of coverage are most common with Medicare beneficiaries but can also result from individuals who receive coverage from their employer as well as their spouse's employer, among other scenarios.

Learn moreMore on Medicare

In the carriers section, we briefly discussed the basics of Medicare. In this section, we'll explore Medicare in more detail and clearly define Medicare Parts A, B, C, and D as well as Medicare Supplement plans. We'll also discuss the relationship between Medicare and Medicaid when individuals are eligible for both.

Learn moreWhat Happens When a Provider Bills my Health Insurance?

In general, this is what happens from the time a patient provides his or her insurance information for a medical visit to when the claim is fully closed by the provider's office.

Learn moreEmployer Health Plans

Approximately half of Americans receive health insurance through their employer, and recent healthcare legislation indicates that this trend will continue and potentially increase. Expanding health insurance coverage is a good thing, but it can be argued that employer-sponsored health plans also mask the true cost of healthcare for many beneficiaries.

Learn moreCOBRA & HIPAA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) and the Health Insurance Portability and Accountability Act (HIPAA) both offer protection for health insurance consumers.

Learn moreHealth Insurance Resources

Links and other resources to refer to for more information on health insurance.

Learn more